The Great Housing Shift Is Coming

Why the seller’s market might be running out of gas.

Home Ownership In America

This past April I went to my Uncle Kyle’s 60th Birthday Bash.

My Aunt Cindy rented out an Airbnb and threw an absolute banger. We’re talking Grateful Dead cover band. Enough kegs to feed a football team. Ninety percent of the guests were stoned.

In between the haze of pot smoke, my dad sipped beer and chatted. Like usual, we talked about finance.

He told me a grand theory about home ownership in America — how it’s the American dream, but that it’s shattering now due to rising costs.

And yet, despite all this, boomers still like to give us millennials crap for not experiencing the taste of home ownership.

So, I did some research for myself. My conclusion: Home ownership is out of reach for many 20-somethings. But the tides may be turning.

The Times Are Changin’

Historically, Americans’ net worths tied to their homes. But it’s worth acknowledging a few factors that make today different than yesteryear.

Social Security is expected to run out by 2037.

The 401(k) started in 1978.

The Roth IRA was born the same year I was — 1997.

The HSA is younger than my little sister — it was born in 2003.

Even today — as I’m writing this piece — the great experiment of non-pensioned or non-social securitized retirement for Americans is still in progress. How are we doing? Honestly, it’s still too early to tell. But Americans are almost at the advisor-recommended 15% contribution amount for the first time ever, according to Fidelity Investments. We’re not perfect yet, but we’re making progress.

Forever Renting

Yes, homes are unaffordable today. But honestly, millennials will probably still end up buying homes.

I dropped the idea of “forever renting” becoming a trend to maximize your flexibility to Paul Millerd, author of the Pathless Path, and champion of not abiding by the default paths in life. His response gave me pause for thought.

“Do people really want to rent forever? Or is home ownership just out of reach today?”

You need a roof over your head. It just seems the time at which you own that roof over your head is getting later and later…

House prices have outpaced income growth nearly 2x in the last 40 years.

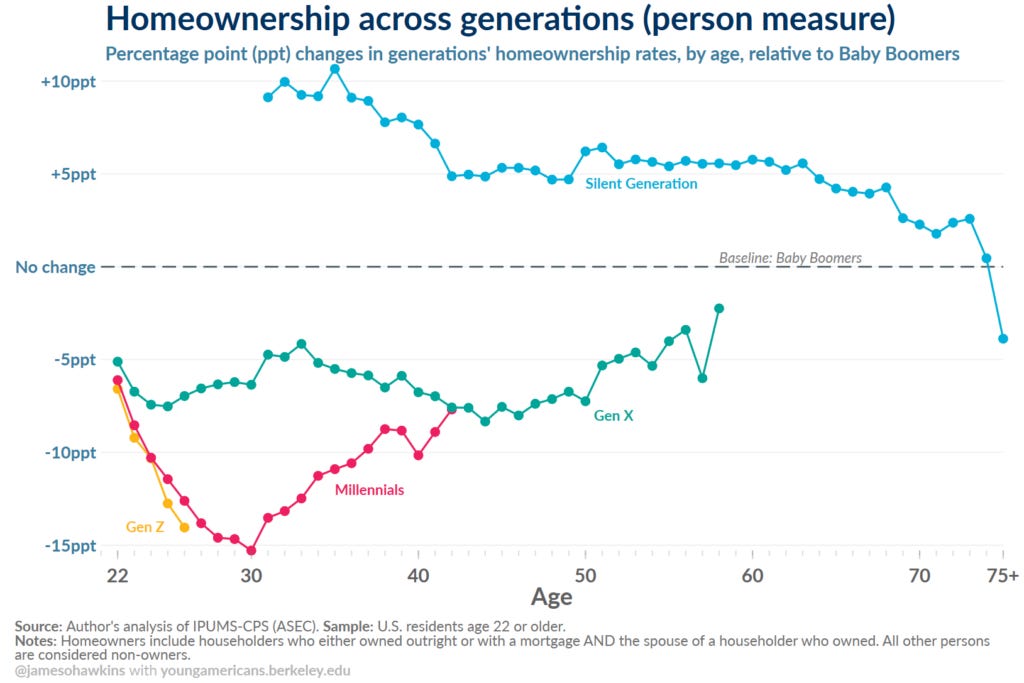

People are waiting longer to buy homes. When you look at individuals within each generation, of the same age, we can confirm this is the case. Data by the Berkeley Initiative for Young Americans showed:

The Silent Generation (currently 79–96 years old) had significantly higher homeownership rates than Baby Boomers (61–79 years old).

Generation X (45–60 years old) is seeing a rise in homeownership — as are Millennials.

My point is this: homes are wildly unaffordable… for now. But fear not!

Cracks In The Housing Market

I had that conversation with my dad back in April. It’s now June, and the tides appear — at least in theory — to be shifting among us.

Lennar, an American home construction company, logged lower profit, citing falling home sale prices.

A home near me that I thought was insanely overpriced has sat on the market for about a month and was cut by a $30,000 price reduction.

It’s nothing more than a hunch. But it feels as though the tides are beginning to turn from a seller’s market into a buyer’s market.

Truthfully, I don’t know. Because it’s too early to tell.

Conclusion

I, for one, am saving up my pennies. My wife and I aren’t in a place to buy a home now. But if all homes go on sale… I wouldn’t mind buying a home for a bargain.

If you’ve been on the sidelines of home ownership like my wife and I, don’t lose hope. The times do indeed seem to be a-changin’.

— Grant Varner

Grant’s Picks

Bob Dylan biopic starring Timothée Chalamet. I’m not crazy about all the biopics these days. But I like Bob Dylan and Timothée Chalamet. Highly recommend this one. I’d give you my Disney+ username/password to watch, but I’m still mooching off my sister’s and her boyfriend’s account.

Makes sense! I think that the prospect of AI-related unemployment will discourage a lot of first time buyers too, which will be another headwind on prices