You Already Have Enough

Why money doesn’t fulfill you.

The First $100k Is A B****

During a Berkshire Hathaway shareholder meeting in 1998, the late Charlie Munger said, “The first $100,000 is a b****, but you’ve gotta do it.”

With a net worth of $2.6 billion when he was laid to rest, he knew the power of compound interest. And that getting the snowball rolling in the first place is harder than letting gravity run its course.

The challenge is getting the snowball ball big enough to get rolling—so you can lay off the gas.

Start Fast, Then Coast

When I ran track & field in high school, I often had to do cross fields. These were long repeat sprints diagonally across the football field.

Our sprint coach timed us so you couldn’t dog it. It was an all out burst for 110m+.

In May, as we entered post-season the humid, muggy, Ohio days made these horrible to do. But I learned a valuable lesson that’d serve me well in high school track, college football, and now building wealth.

It’s easier to start fast, and coast through the finish than it is to start slow, and rush to the finish.

Inspired by Munger, I set out to ‘pack on the snow’ as fast as humanly possible—like I did in high school track.

But is $100k in 2026 the same worthy wealth building goal it was in 1998? Hardly.

One hundred grand back in 1998 is worth $198,847.85 in 2026.1 It’d take a high paying job to get there.

After soliciting the advice of some people who are smarter and more successful than me, I landed upon a potential path: tech sales.

The Payoff

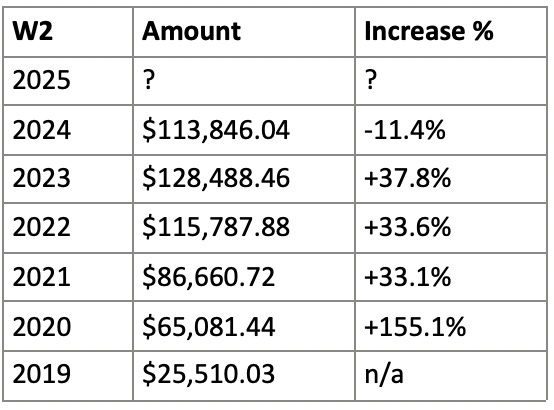

From 2019-2024 I made $535,374.57 in W2 earnings. It worked. Most importantly, I managed to save a lot of that.

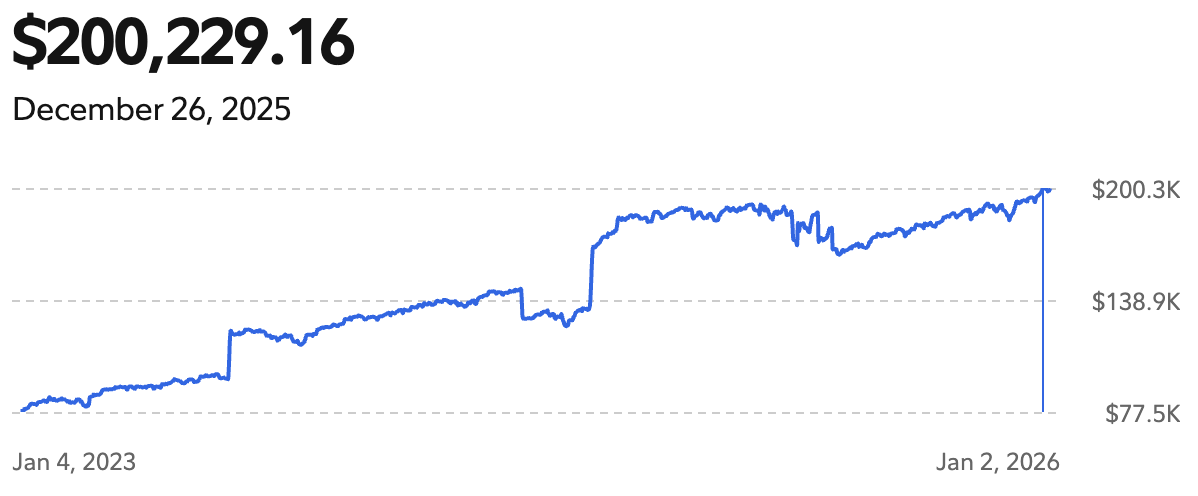

As of December 26, 2025 (28 years old), I finally have my proverbial snowball Munger talked about—adjusted for inflation.

I currently have $200,000 in tax-advantaged retirement accounts, invested in low cost index funds. Better yet, $55,470.84 (over 25% of my portfolio) was from growth—early signs of the rolling snowball.

Assuming a conservative 6% interest rate—and assuming I don’t contribute another cent for the rest of my life (other than reinvesting the interest), I’ll have $1,363,976.45 to retire on by 60.

But here’s the rub: I’ll never actually have enough money. But that’s OK because I already have everything I need in life.

“At a party given by a billionaire on Shelter Island, Kurt Vonnegut informs his pal, Joseph Heller, that their host, a hedge fund manager, had made more money in a single day than Heller had earned from his wildly popular novel Catch-22 over its whole history.

Heller responds, “Yes, but I have something he will never have—enough.”

I Already Have Enough

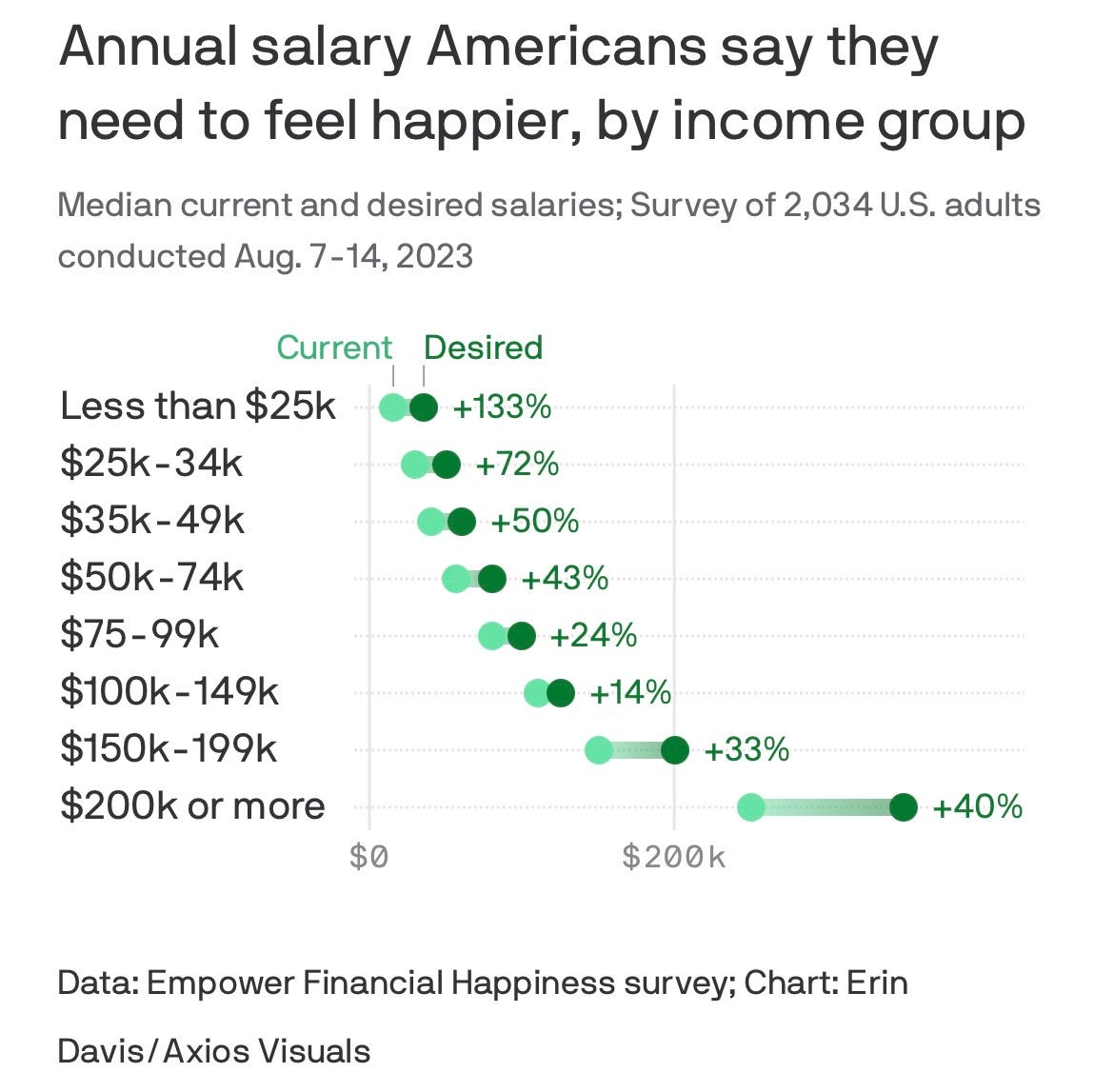

Paradoxically, two things are true about money and happiness.

No one has enough money. If you asked anyone—of any amount of wealth—they’d think they need more money to be happy.

I already have enough money because I don’t need any more money. I already have what I need to be happy: God, family, and friends.

On August 12, 2023, I invested my first $100,000–a big financial milestone.

This past week, I hit another financial milestone: $200,000 invested. That day, I wrote in my journal.

“When I hit $100k, I thought my life would change. It didn’t. Now I’m at $200k and my life still hasn’t changed.”

In retrospect, that wasn’t 100% accurate—my life did change a lot during the time I grew my net worth from $100k to $200k.

But it had nothing to do with money, and everything to do with relationships.

I married the love of my life. I went to the weddings of some of my best buddies from High School and College. I went on vacation with my family.

I don’t have enough money. Because I never will. But I still have more than enough.

Thanks for reading.

— GV

Based on the CPI Inflation Calculator. It’s important to note that the actual purchasing power of $100k from 1998 to 2025 can vary depending on your location and daily expenses. For example, $100k in 1998 is equivalent to $310,404 in San Diego, CA, but only $177,124 in Chicago, IL. The key takeaway is that the value of money has decreased over time, making it important to start building a nest egg as early as possible.