Be Greedy When Others Are Fearful

And fearful when others are greedy.

As manager of the Magellan Fund — from 1977 to 1990 — Peter Lynch averaged a 29.2% annual return, consistently doubling the S&P 500, making it the best-performing mutual fund in the world.

Lynch was a practitioner of value investing, and had a knack for simplifying complex financial concepts into a way that a layman can understand. My dad bought me his book “Beating The Street” for my 21st birthday, and his investing principles have become ingrained into my financial life.

1. Hold onto stocks in the midst of tough markets.

During the COVID-19 market crash in March 2020, the S&P 500 dropped 34%. At 23 years old, I took all my cash (other than money earmarked for rent, groceries, and beer) and bought as much S&P 500 as I could afford without going broke. Those shares are the best gains in my portfolio.

2. Be optimistic in the long run; ignore doomsday predictions.

On December 31, 2021, the S&P 500 hit an all time high at $4,766. From that point on, the market stagnated and it took over a year until it finally reached its previous on January 12, 2023. With each paycheck, I watched more money get invested, with nothing to show for it. But I held onto my long run optimistic view of the economy, and it eventually paid off. Looking back, I realize that I was just buying my stocks on sale.

3. Index funds have advantages over active funds.

I used to trade individual stocks. The issue is that I didn’t have the stomach to hang onto individual stocks when their price went down. Now, I only buy low-cost index funds now, and save the headache, transactions costs, and loss that come with selling at the bottom. As a result, I spend no more than a few hours per month managing my portfolio, and get to spend more time doing what I love.

Time In Market vs. Timing the Market

There’s only one advice that I actually don’t entirely agree with Peter Lynch on. His advice to never time your investments. I actually think it’s better to time the market, and I’ll show you how.

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”1—Peter Lynch

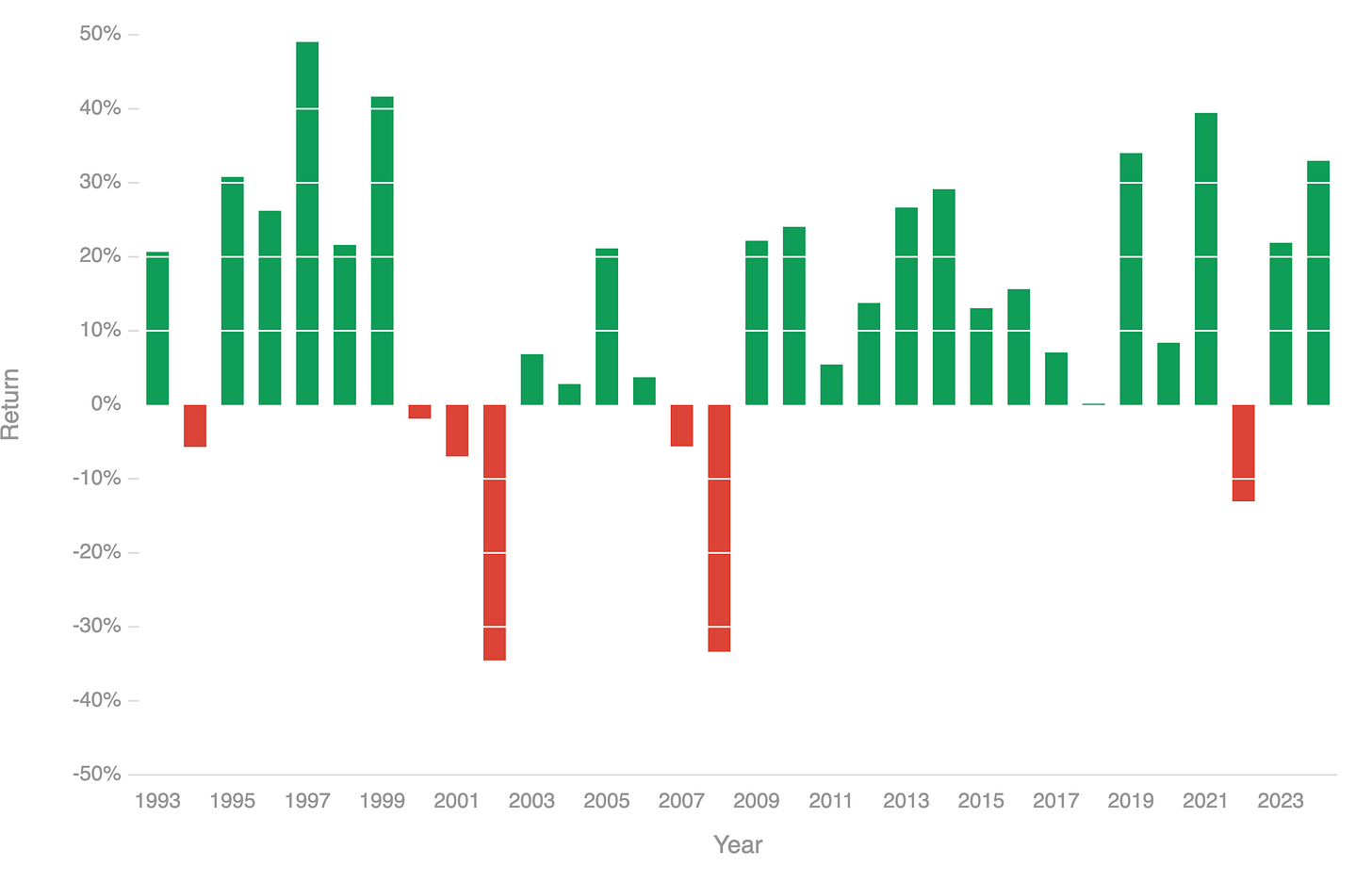

The S&P has generated a positive return for seven of the last twenty years. Looking at a zoomed out graph from year-to-year might tell you that it’s best just always be dollar cost average since you’ll win in the long run.

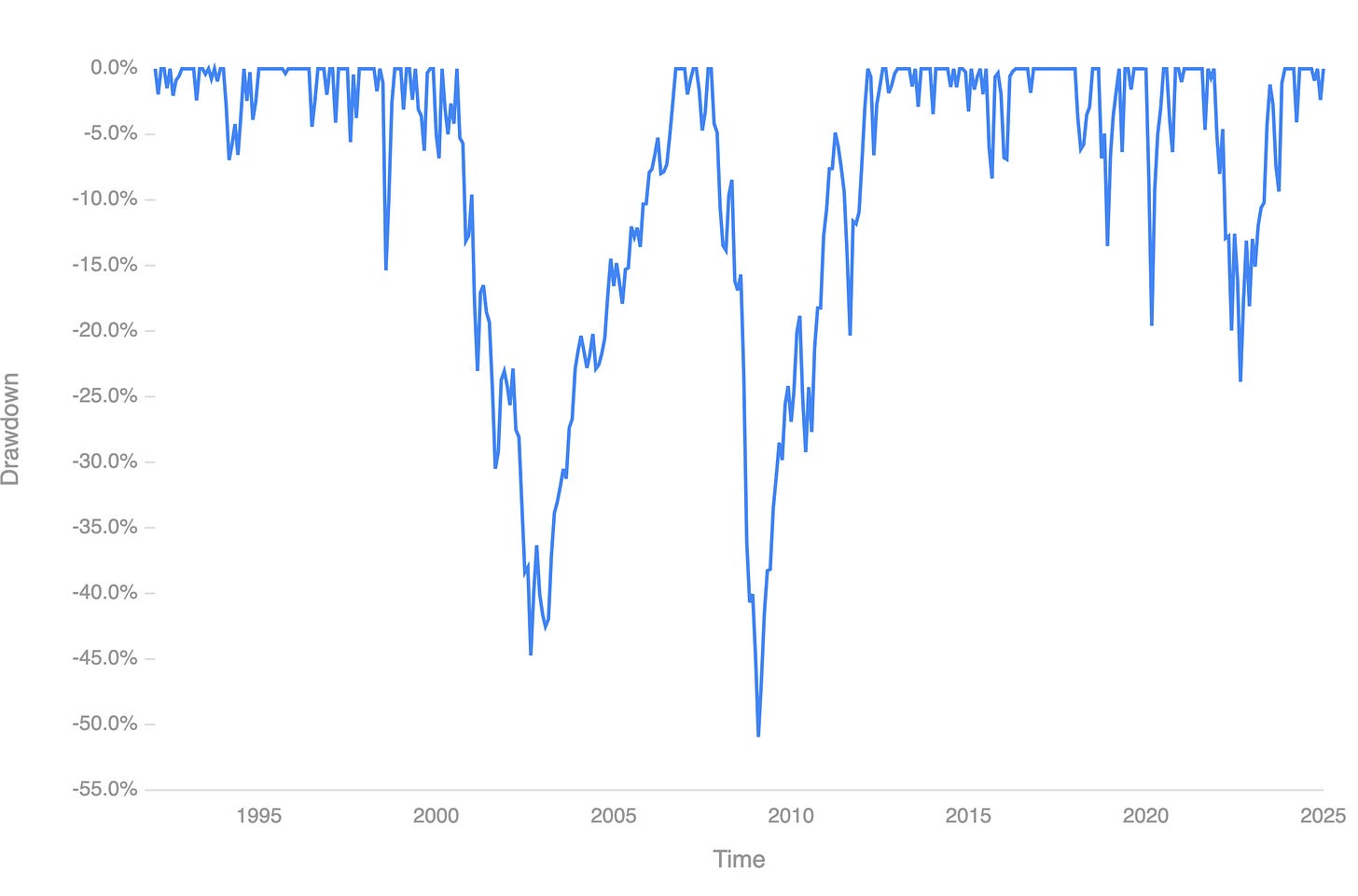

But when you look at the drawdown charts for each year, you’ll find that even within years where the market made significant gains, there are still short periods of loss. The 2020 stock market crash is the best recent example: from March 9 to March 16, 2020, the S&P fell over 30%.

Yet, overall in 2020, the S&P was up 18.4%. This is an extreme example, but every year there are opportunities where you can take advantage of the drawdown. Every year, the headlines show that the market is fearful.

The main point here is that:

In years where the S&P 500 made gains, there are opportunities throughout the year to invest in short-term downturns where the market is fearful.

Likewise, when the S&P 500 made losses over the year, if you had stayed the course by continually investing, those shares would have earned you a lot of money in the future.

September 2021

In September 2021, the S&P dropped 4.7%. An article on CNBC cited “The weakness for the market came on the final day of what has been a rough month for equities, as rising rates, inflation fears and concerns about the Chinese property market have roiled stocks.”2

And yet, overall in 2021, the S&P was up 28.7%. Be greedy when others are fearful.

March 2025

Even right now, in March 2025, the S&P has fallen nearly 10% since February 13, 2025, and all the articles I’m reading are talking about a recession.

Be Greedy When Others Are Fearful

I don’t have a crystal ball about what the final return will look like by the end of 2025, but I’m long-term optimistic that eventually, the S&P price will continue to rise. With all this talk of a recession, the advice from Warren Buffett is ringing in my ears.

“Be fearful when others are greedy. Be greedy only when others are fearful.” — Warren Buffett

While studying economics at Brown University, I read “Buffett: The Making of an American Capitalist”, a biography about Warren Buffet. This book taught me another lesson that Warren Buffett learned from his mentor, legendary value investor, Benjamin Graham.

“In the short run, the market is a voting machine but in the long run it is a weighing machine.”3—Benjamin Graham

Like Peter Lynch, Buffett had a long-term optimistic view of wealth creation in the American economy. He believed that in the short-term, markets can become frothy and overpriced. And at other times, fearful and undervalued.

In Berkshire Hathaway’s (Warren Buffett’s holding company) annual letter to the shareholders, Buffett had to defend the $321 billion pile of cash that Berkshire was sitting on, saying that Berkshire Hathaway will never prefer cash over ‘good businesses’.4

How I’m Investing

I’m licking my chops because I love a good bargain. In the last 20 years, we’ve only had 7 years where the market decreased in value.

I’ve grown my portfolio from $64k to $185k in the last 3 years by investing in low-cost index funds—only investing when the Fear and Greed Index reaches extreme fear.5

I never sell, I’m long-term optimistic about the markets, and I only buy low-cost index funds, like the S&P 500.

What We Can Learn From Peter Lynch

Peter Lynch is a man who knows investing. He gave us the principles to build wealth, which we often needed to be reminded of, than informed of. It’s been said before that all the financial advice you could ever need can fit on a single 3x5 index card.

To become wealthy in the long-term you just need to;

Buy low-cost index funds when the markets are fearful.

Resist the urge to buy when the markets are greedy.

Don’t sell when everyone is preparing for the next recession.

This strategy is so simple that even a caveman like myself can figure it out. The hard part is having:

The patience to not touch your portfolio for long periods of time.

The courage to hold when everyone else is selling.

The foresight to not invest in the next hot stock or asset, and to just stay the course.

I’ve grown my portfolio +$121k in the last 3 years using this strategy. The recent losses by the stock market are testing my investing philosophy as we speak. Hopefully I can stay strong, and stay the course.

— Grant Varner

Peter Lynch, “From the Archives: Fear of Crashing,” Worth, originally published September 1995, republished March 9, 2017. Available at: Worth.com

Pound, J., & Stevens, P. (2021, September 29). Dow drops 500 points on September’s final day, S&P 500 suffers worst month since March 2020. CNBC. Retrieved from https://www.cnbc.com/2021/09/29/stock-market-futures-open-to-close-news.html

I couldn’t verify the original source of this Benjamin Graham quote, but The Intelligent Investor remains a legendary book on value investing and is worth referencing in the footnotes.

Langley, K. (2025, February 22). Warren Buffett defends his growing cash pile. The Wall Street Journal. https://www.wsj.com/finance/investing/warren-buffett-berkshire-hathaway-letter-2025-9c4530f8

The Fear and Greed Index, developed by CNNMoney, measures the emotions driving the stock market by analyzing factors such as stock price momentum, market volatility, and investor sentiment. When the index shows a high level of greed, markets tend to be overbought, while extreme fear signals potential buying opportunities. For more information on the index, visit CNNMoney's Fear and Greed Index.