Buy Inner Peace Instead Of Passive Income

The 2008 financial crisis, the optionality of cash, and why boring investments are often the best investments.

(I) The 2008 Financial Crisis

When I was 11, my parents sat my sisters and me down at the breakfast table with salt sticks from Bialy’s Bagels in Cleveland. They said, “We’re moving to Columbus.”

It was spring 2008—the peak of the financial crisis. Cleveland was hit particularly hard. While I was busy trying to beat Through The Fire And Flames on Guitar Hero 3, my parents were trying to figure out how to keep the family financially solvent. So, we packed up and moved in with my grandma in Columbus.

Moving in with my grandma wasn’t too bad. In fact, it was a lot of fun.

What I didn’t recognize at the time - but do now - is that life experiences like this shaped how I view money and my relationship with risk.

Especially because I value freedom and autonomy above all. Now, as an adult with my own family, the thought of being forced to move from a town we love is a reality I hope to never face.

While recessions are less frequent today, when they hit, they hit hard. In those moments, cash is king.

Not just because of what it buys, but because of what it prevents: stress, panic, and missed opportunities.

(II) Cash Buys Inner Peace

The first thing to know about holding cash is that it’s really about reducing stress. Sure, holding too much might be suboptimal if you're chasing max returns. But a long cash runway gives you peace of mind.

This is an example of how not to think about cash:

I was walking down the shampoo aisle at Target with my wife when it hit me—“Holy shit, we could get another $1,500 per year if we just put our emergency fund into a money market account!”

We were leaving money on the table. As soon as I got home, I moved $15,000 into a money market fund.

But over the next few months, I hit rocky roads at work. The stress piled up. Eventually, I sold the money market funds - and most of the stock in my taxable brokerage - during a post-tariff rally.

What I failed to calculate were the hidden benefits of holding cash - even if it's a mathematically suboptimal investing strategy.

(III) Cash Is An Option To Buy Something In The Future

There’s a tipping point I feel when I accumulate savings in cash. At first, it feels fantastic. When markets get rough or a deal I’ve been working on falls through, I stay calm because I’ve got margin to weather the storm.

But then comes the doubt: “Should I be getting a better return on this cash?” And in that moment, I forget:

Cash in the bank is FDIC-insured.

Everything gets cheaper during a recession.

Cash is harder to come by during a downturn.

The average unemployment duration in the ‘08 recession was 6 months.

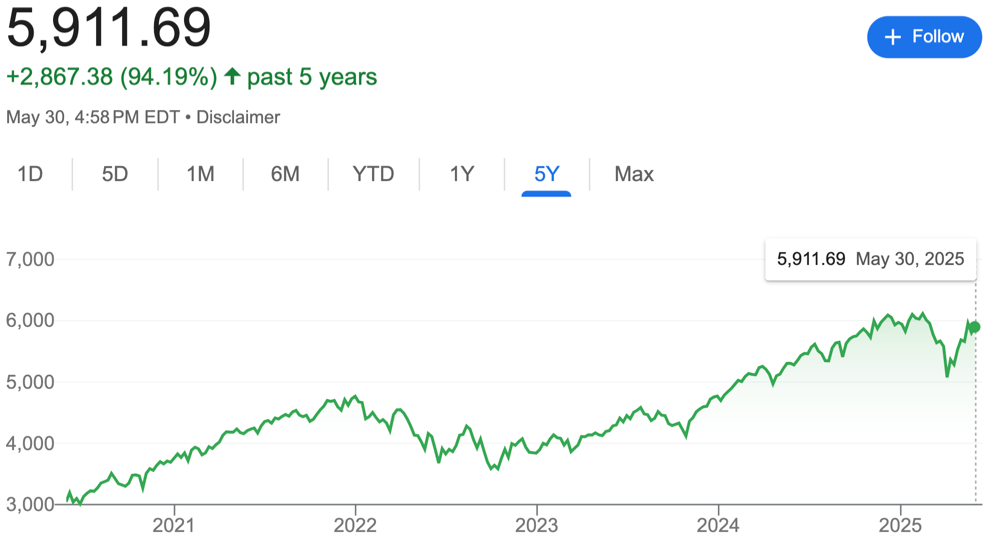

No one could’ve predicted the COVID-19 recession - the shortest on record at just 2 months. And yet, because I’d kept cash on hand, I was able to buy a ton of stock when prices tanked.

How much cash to keep comes down to your personal relationship with risk.

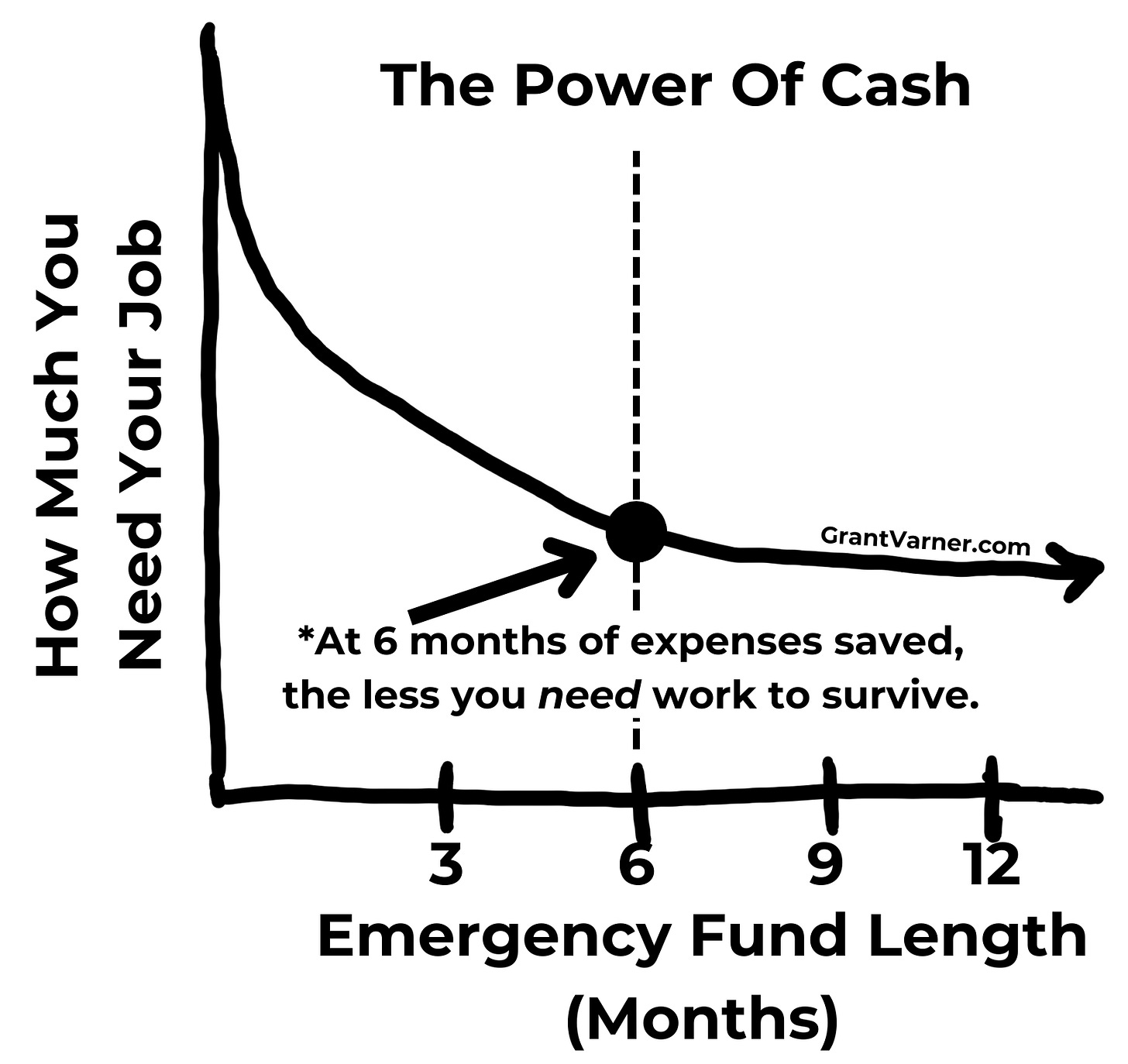

(IV) More Cash = Less Need For Work

The more cash you have saved up, the less you need to work.

When I got laid off from Oracle, I was lucky enough to get decent severance. But I’d also been saving for a while, so I had a cash cushion. My wife and I were engaged at the time, and since it was summer and she was off from school, we said, “Screw it, let’s go to Egypt.”

We flew to Egypt, stayed at a resort, spent time with her family, and lived it up. One of the best unplanned decisions we’ve made. None of it would’ve been possible without a savings buffer.

If you keep cash on hand, you give yourself the chance to turn lemons into lemonade.

(V) The Middle Way

Aristotle said, “Happiness is the meaning and the purpose of life, the whole aim and end of human existence.”

The purpose of money, rightly ordered, is tied to that aim. It’s a balancing act.

Be a cheapskate who’s too risk-averse, and you do diddly squat with your money other than stare at it in a bank account.

Be a high roller who’s always spending to impress and taking wild risks, and you risk ending up with nothing.

(VI) Controlling Your Time Is The Highest Dividend Money Pays

A few weeks ago, I was at my friend’s wedding. While hovering by the kitchen for my hundredth Swedish meatball appetizer, I started chatting with one of the groom’s impressive friends - a high-earning consultant.

I asked him, “What advice would you give someone just starting out?”

He said, “Don’t get into real estate.” This is coming from a guy who owned several duplexes in Cleveland.

He explained how he had to leave work to fix broken drains and sinks. He could’ve hired a property manager, but to make the properties cash-flow, he had to give up his time.

It got me thinking - are all dollars created equal?

Short answer: No.

(VII) The Return On Hassle

Nick Maggiulli, on his blog Of Dollars And Data, talks about the return-on-hassle spectrum. In short, not every dollar is worth the same.

Assuming you're not trying to keep up with the Joneses (a topic for another day), not every invested dollar is equal either.

As mentioned, active real estate investing sounds great - until you’re getting a call from a cracked-out tenant at 10 p.m. because they locked their roommate out.

(True story. My buddy had to peace out from a poker night early to copy a key at Kroger for a tenant).

Meanwhile, my stock portfolio has never smoked crack. Or asked me to make a key copy during poker.1

(VIII) A High Earning W-2 Job Is A Cheat Code To Wealth And Freedom

I see Substack notes like this all the time:

I actually disagree. If you can land a high-paying, flexible W-2 job, live below your means, and invest the rest, your financial margin grows.

Over time, freedom comes - not in one glorious moment of fireworks - but in phases:

Non-Mortgage Debt Paid Off: Breath a sigh of relief.

Emergency Fund: Big or small, depending on your risk profile.

Home Paid Off: You own it. No one can take it from you. Plus say goodbye to monthly house payments.

Investments Working for You: One day, your portfolio earns passively what you were earning actively (or more).

When that happens, you begin to ask: “Do I actually like my job?” And you can afford to say: “Yes, but only on these terms.”

(IX) Conclusion

If your takeaway from this post is “real estate = bad,” I didn’t do my job.

My buddy? He got his commercial real estate license. He has a passion for the space. His brother - the handyman of the duo - fixes everything. So for them, real estate is the right path.

But it’s not for me.

The main point: Real estate is not the only path to wealth. It’s just been overhyped.

The truth:

Real estate can make you rich.

Starting a business can make you rich.

A high-paying job + low cost index can make you rich.

There’s more than one way to skin a cat. Find the one that works for you.

Grant’s Picks

“No Worries” by Jared Dillian: A great book that put into words what I feel about cash. His chapter “The Power Of Cash” was an especially, um, powerful.

Nick Maggiulli’s blog post: The Return on Hassle Spectrum - A sharp take on weighing returns against headaches.

This tweet by @fed_speak: A well-deserved roast of real estate Twitter. Again, nothing against real estate - It’s good for some people. But it’s definitely a different animal than good ‘ol stocks.

One caveat here: real estate often comes with leverage and tax advantages. Someone buying a duplex might house hack, by living in one half and use an FHA loan to put less money down. They’re investing with less upfront cash and subsidizing their own living costs. Just another reminder that not every dollar invested is created equal.