Can You Buy Happiness?

...

My career path in tech sales is boom or bust. Some months are great, and I make a lot of money. Other months, it’s not so great.

Having so many ups and downs has taught me that:

Money is impermanent.

The short-term satisfaction that comes with income increases is dependent on how you’re doing in comparison to your peers—for better, or (mostly) for worse.

The most reliable way to be happy is to build a baseline amount of income—and using that money to “buy” happiness in small, meaningful ways.

The Easterlin Paradox

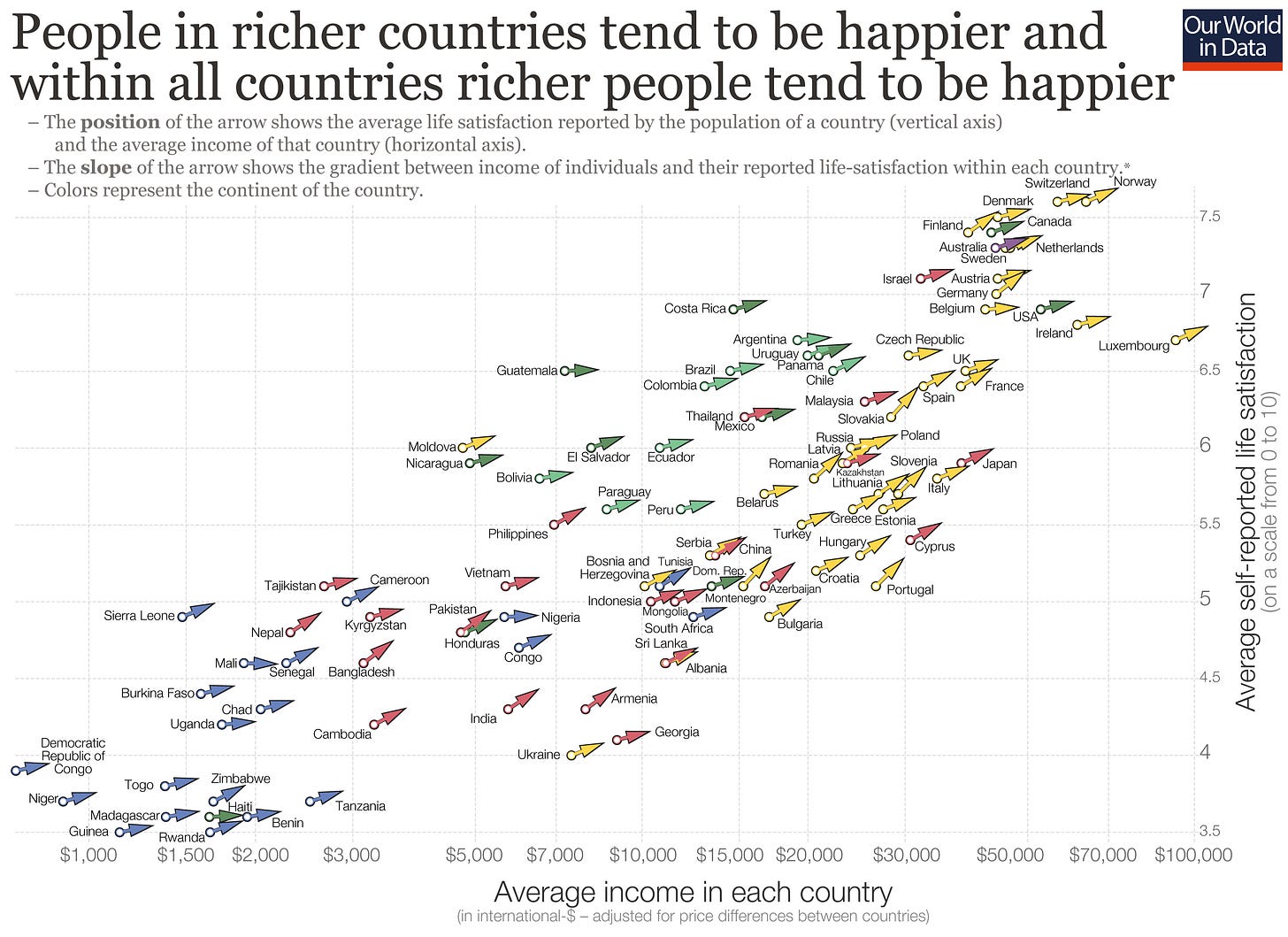

In 1974, economist Richard Easterlin pointed out something strange: at any given moment, richer people (and richer countries) tend to report higher happiness. But as countries get richer over time, happiness doesn’t always increase, too.

That paradox is what people call the Easterlin Paradox.

The annoying part—hence the paradox—is that happiness messy. Even Our World In Data shows growth and life satisfaction often move together across time—just not as cleanly as the snapshot comparison.

Why The Easterlin Paradox Makes Sense

Makes sense, right? Richer people in a country are generally happier than poorer people.

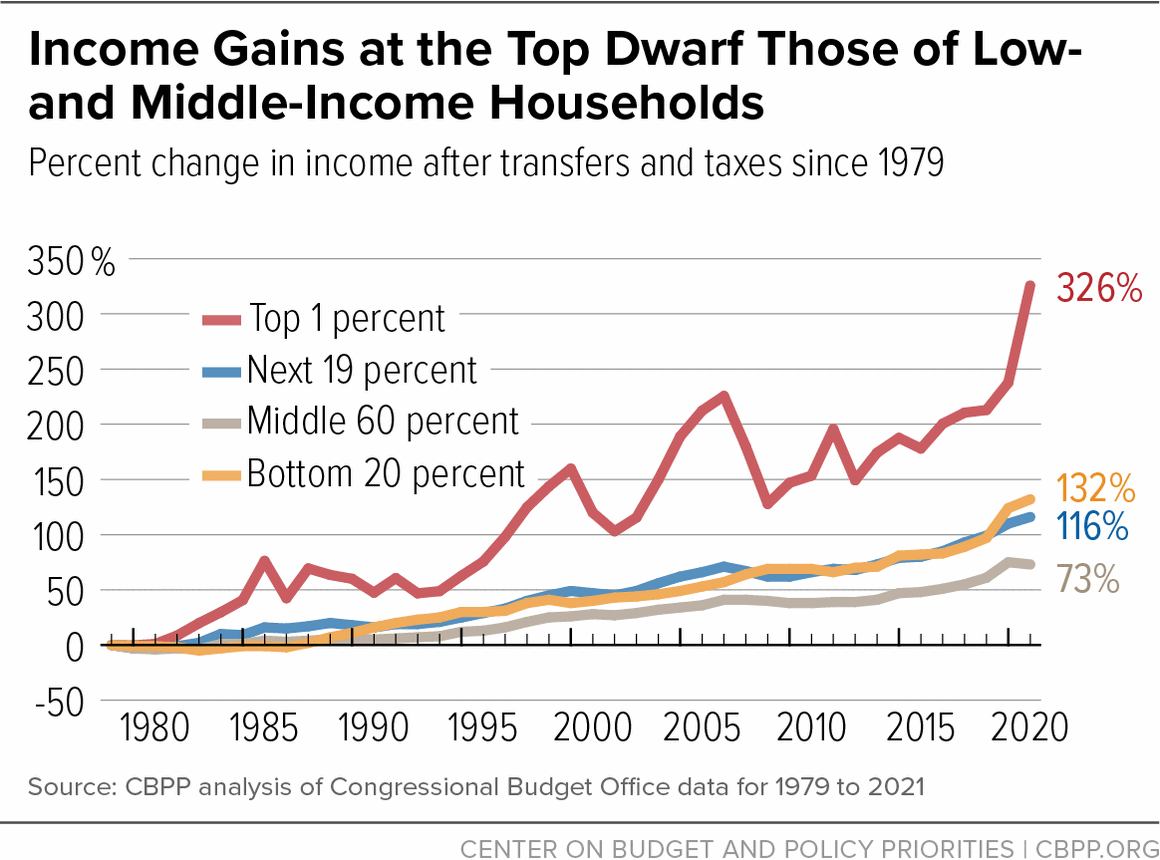

In recent decades, growth has not benefitted the majority of Americans. In fact, income inequality is quite high, and has been growing since the 1980s.

In a perfect world, we wouldn’t compare ourselves to others. But we’re human. That’s what we do.

Perception is everything. Your comparative financial situation to your peers matters more than your absolute financial situation to the world.

Earning increases only make you as happy as you think you’ll be in comparison to others.

Given these two options which would you choose?

Option A: You make $50,000 while everyone else earns $25,000.

Option B: You make $100,000 while everyone else earns $200,000.

When David Hemenway and Sara Solnick asked participants this question in a study, 50% chose Option A. Opting to make $50,000 less. But more than their peers.

How Much Money Helps?

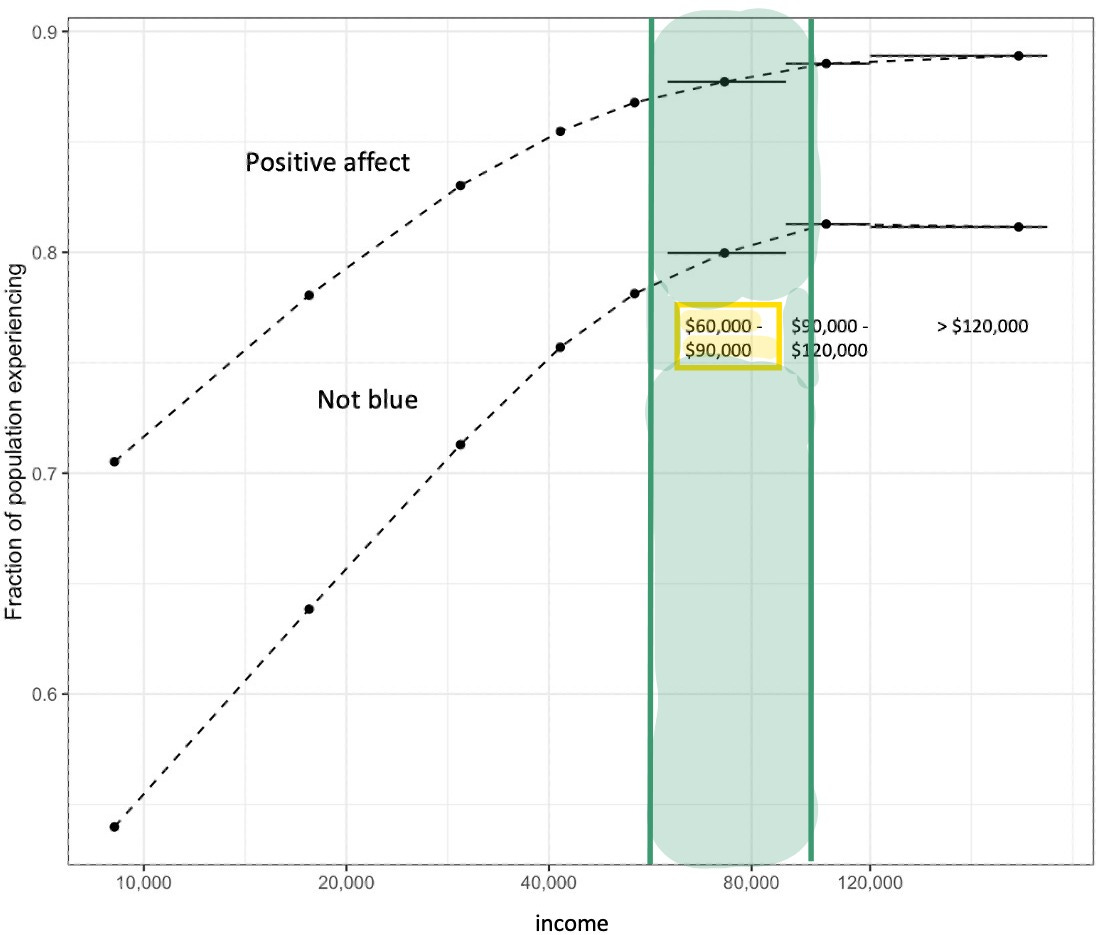

The famous “$75k plateau” came from Kahneman & Deaton (2010).

Money tends to buy happiness, but not evenly. For most people, money helps them continue to be happy. But for a chronically unhappy minority, it plateaus.

Money can’t buy happiness. Unless you’re Elon Musk, someone’s always going to have more money than you. I can’t speak for Elon, but if you are Elon, having more money probably won’t make you happy.

So what can you do to be more happy? One option is to make $112,711.

Even if your income rises, the scoreboard you’re using might be your peers, rather than your past self.

In 2022, Matthew Killingsworth, Daniel Kahneman, and Barbara Mellers wanted to answer this exact question I’m asking today: Can money buy happiness?

They found that yes, money does indeed “buy” happiness. Emotional well-being increased with more income. But then it flattened somewhere between $60,000 and $90,000 per year.

Because this paper was released in 2022, the amount where happiness levels off is somewhere between $75,140 and $112,711 in 2026 dollars.

Build Your Own Baseline

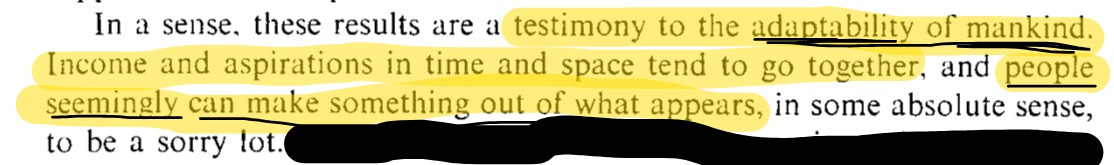

Easterlin’s takeaway? Man is adaptable to any situation.

To paraphrase Bruce Lee, “Be water, my friend.” Humans have a rare ability to adapt to our present circumstances.

During prosperous times, remind yourself that fulfillment doesn’t come from increasing your lifestyle.

During times of material poverty, don’t worry, because you will adapt to your situation. You’d be surprised by how little you need to be fulfilled.

Reminder To Myself

Is money not making you happier? It could mean one of two things:

You’re already so satisfied with so many aspects of your life, that you don’t need more money to be happy. As a result, more money is numb.

You have deeper issues that need to resolved, which can’t be resolved with money.

If it’s the former, that’s great. If it’s the latter, it might be time to think about what’s going on.

Thanks for reading.

— GV