The Wealth Ladder: Book Notes

Book notes from reading "The Wealth Ladder" by Nick Magiulli.

I buy a lot of books. But finish few of them — only about 10% of the books I start. The Wealth Ladder by Nick Maggiulli is one of few books that I did finish. I highly recommend you buy it for yourself. But before you do, here’s my attempt to distill the immense amount of wisdom Nick shares into 2,500 words.

Earning Up The Wealth Ladder

As your income increases, so does your wealth. Your income today is the bedrock upon which all your future wealth will be built tomorrow. In a word, get your money up, not your funny up. But beyond W-2 income, there’s four kinds of leverage to make more money:

Labor: Paying someone to work for you is one of the oldest forms of leverage. It requires you to rely on your workers.

Capital: Using your own (or someone else’s) money to increase your wealth.

Content: Anyone can share content at scale (that’s what I’m doing with this blog). But because everyone can easily share information, competition is fierce. It requires (i) excellence and (ii) consistency to stand out.

Code: Like content, anyone can sell code. But it requires a highly technical skill, and is highly competitive.

The .01% Rule

Sharp income drops are more likely among high earners.1 Consuming based solely on your income puts you on unsteady ground. Personally, this opened my eyes. My household earnings are higher than average for the typical American my age, but it’s a good reminder that layoffs are frequent, so it’s important to live below my means, save, and invest.

When it comes to spending, it’s better to spend based on your liquid net worth using the .01% rule: You can spend .01% of your liquid net worth without worry. If you have $200,000 in cash, you can spend $20 worry free. The distinction here is liquid net worth. If your money is tied up in your 401(k) like mine is — it’s better to spend care free based on what’s in cash.

Level 2 ($10K-100K): Grocery Freedom

You can buy what you want at the grocery store without worrying about your finances. At this stage I started buying ribeye steaks from Costco.

To ascend past $100K net worth, find work at the intersection of:

What you’re good at.

What you’re interested in.

What people will pay for.

And whenever you’re in doubt about your career, work harder — especially at sub-$100K net worth. Per Sam Altman:

“Working hard early in your career to get the leverage and compounding effects is underrated and one of the most valuable pieces of advice that I ever got.”

Level 3 ($100K-$1M): Restaurant Freedom

You can eat what you want at restaurants. At this stage I tried buying steaks at restaurants, only to find out that steaks I grill at home taste much better.

To get to your first $1M, it’s best to start fast, then coast later. If you invest more earlier, and stop contributing later, you’ll be just fine. Just don’t overdo it though — in either direction.

Save your money, but still be willing to spend your money on fun things. Otherwise you might come to regret it when you do reach the $1M milestone. I’m going skiing for one of my college friends’ bachelor party — along with one of my buddy’s who I played college football with at Brown. Since we both have never snowboarded before, we each dropped $600 on lessons. My knee jerk reaction was to think this is an absurd amount of money. But at the same time, it’s gonna be so much fun — and a memory I’ll have forever.

On the other side of the same coin, avoid overspending. Homeowners with $100k-$1M tend to have 65% of their assets in their home. In most cases, your primary residents is a use asset — just like a car. Try not to stretch yourself too thin by buying something above your means so that you can keep the snowball rolling to fund the life you want in the future.

If you avoid overspending, increase your income, and invest consistently, Level 4 ($1M+) will come in a jiffy.

Level 4 ($1M-$10M): Travel Freedom

You travel when and where you want.

Your 9-5 job that got you to $1M won’t get you to $10M. Equity is how you get there.

“To become rich, every single percentage point of anything you own is crucial. It is worth fighting for, tooth and claw. It is worth suing for. It is worth shouting and banging the table for. It is worth begging for and groveling for. In extremis, it is even worth negotiating for. Never, never, never, never hand over a single share of anything you have acquired or creating if you can help it.” — Felix Dennis

Level 5 ($1M-$10M) households have 31% of their assets in businesses. Start a business. Buy a business. Get equity. I’m not at $1M+, so my focus isn’t here yet, but one day, it will be.

Level 5 ($10M-$100M): House Freedom

You can afford your dream home with little impact on your overall finance.

The characteristics that got someone to $10M are likely the same ones that will prevent them from stopping when they do get there. Being money-driven has advantages, but beyond being able to pay for the basic necessities, no amount of money will ever satisfy. In fact, there’s convincing evidence that going beyond $10M+ net worth might actually be a downgrade to your life.

Loss of trust: Wealth can change your relationship with others because you don’t know if they are interested in you or your money. This is why the friends you had before you’re wealthy are so important. Because you know they liked you for who you are and not because of the wealth you have today.

Increased stress: One study found that the relationship between wealth and mental health an inverted U shape. In other words, more wealth is associated with better mental health… to a point. Beyond the peak, more wealth led to decreased mental health. William Vanderbilt echoed this sentiment when comparing his life to a less wealthy neighbor:

“He isn’t worth a hundredth part as much as I am, but he has more of the real pleasures of life than I have. His house is as comfortable as mine, even if it didn’t cost so much; his team is about as good as mine; his opera box is next to mine; his health is better than mine, and he will probably outlive me.

And he can trust his friends.”

Altered family dynamics: Moving up the Wealth Ladder often requires sacrifices from you and from your loved ones — no matter how you ascend the Wealth Ladder. If you have a demanding job, this could lead to long hours and time away from your family. If you run a business, that might also take time from family, and doing other things that you love.

Level 6 ($100M+): Philanthropic Impact Freedom

You can use money to have a profound impact on the lives of others (e.g., engage in large-scale philanthropy, buy businesses, etc.).

One problem some face while ascending the Wealth Ladder is that the higher you climb, the more wealthy people you meet — many of whom will be wealthier than you. Misha Saul explains relative deprivation:

“The more of an outlier you are in any respect (money, intelligence, beauty, chess, archery, whatever), the larger the gaps between you and the next best above and below. If you are median wealth, well, so are many others (by definition).”

As a result, you can feel like you need to catch up to those wealthier than you. Wealth can morph your perceptions past the point of necessity.

Does Money Buy Happiness?

As Kahneman and Deaton found in their 2010 paper, “Unhappiness decreases with increasing income, but there is no further decline beyond ~$75,000.” No one is immune to unhappiness, no matter how much money they have.

Money itself doesn’t make people happier. But what money allows you to do, can make you happier. The comedian Bill Hicks once said, “Money can't buy happiness. But it can buy a jet ski and have you ever seen someone frown while riding a jet ski?”

All this being said, the ideal strategy for maximizing happiness seems to be having enough money to alleviate struggle and worry, then focus on things other than money. As the saying goes, “Money can’t buy happiness, but poverty can’t buy anything.” Felix Dennis has a net worth of $750 million. Regarding wealth, he once said:

“If I had my time again, knowing what I know today, I would dedicate myself to making just enough to live comfortably (say $60 or $80 million), as quickly as I could — hopefully by the time I was thirty-five years old. I would then cash out immediately and retire to write poetry and plant trees.”

The Great Enhancer

In the same way that salt enhances the existing flavor already in your food, money elevates the experiences you have in life. My wife and I love sushi. Spending $30 on all-you-can eat at a spot near us is light years better than buying the $6 sushi from the grocery store. It’s still sushi. Just better.

Eventually comes the question: I already have enough money. How do I get more “flavor” out of life? Sahil Bloom lays it out in The 5 Types of Wealth:

Social Wealth: Dr. Matthew Lieberman found that seeing a friend on most days was worth making an extra $100,000/year. Being married was worth an additional $100,000. Seeing your neighbor regularly was worth $60,000. What’s more, leaving a toxic relationship, or changing jobs due to a bad boss will dramatically improve your life.

Mental Wealth: According to a 2021 report by Pew Research Center, work was one of the biggest sources of meaning for people across seventeen advanced economies. If you don’t love your work right now, that’s OK — but that should be your goal. Because work can be a great source of fulfillment. To quote Richard Nixon:

“The unhappiest people of the world are those in the international watering places like the south coast of France, Newport, Palm Springs, and Palm Beach. Going to parties every night. Playing golf every afternoon, then bridge. Drinking too much. Talking too much. Thinking too little. Retired. No purpose. As so, while I know there are those who would totally disagree with this and say, ‘Gee, if I could just be a millionaire that would be the most wonderful thing. If I could just not have to work every day. If I could just be out fishing or hunting or playing golf or traveling, that would be the most wonderful life in the world’, they don’t know life. Because what makes life mean something is purpose. A goal. The battle. The struggle. Even if you don’t win it.”

If you want mental wealth, don’t avoid work, embrace it. And if you believe that your work has purpose, you’ll have greater meaning in your life.

Physical Wealth: The Roman poet Virgil once wrote, “The greatest wealth is health.” Over two thousand years later, the rapper Pusha T said, “Ask Steve Jobs, wealth don’t buy health.” The earlier research from Dr. Matthew Lieberman also found that health was “by far the most valuable non-monetary asset researchers examined. To be maximally healthy, there’s two metrics worth pursuing: (i) Physical strength. In a study of active male firefighters, those who are stronger had a 96% reduction in heart attacks. (ii) Cardio strength. Having a VO2 max in the top 2.5% for your age drops your risk of death by 80%. Even going from the bottom 25% to the 50th-75th percentile reduces your risk of death by 50%. For context, a non-smoker only has a 29% lower chance of death compared to a smoker.

Time Wealth: I take after Charlie Munger who said, “The first $100,000 is a b****, but you’ve gotta do it.” I’ve written about how starting fast, then coasting is the best route for a wealth building journey.

My (Grant Varner’s) Journey Up The Wealth Ladder

Currently, I’m at Level 3 ($100K-$1M). Here’s what I’ve learned along the way.

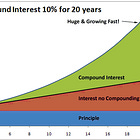

Start fast, then coast. Because of the power of compound interest, it’s easier to start fast, and coast through the finish than is to start slow, and rush to the finish to make time. So far, this principle has served me well in building wealth. It taught me that when it comes to wealth-building, it’s far easier to sprint out of the gates. By intensely focusing on maximizing income, minimizing expenses (without overdoing it), and investing the rest, I got the snowball of compounding interest started.

I don’t know how it feels to be playing catch-up on your financial life at age 50, but I can tell you that I never felt like I was missing out on anything. Even though I was financially disciplined, I was able to backpack through Europe, take two trips to Big Bend National Park, eat out often with friends — mostly at Juan in a Million or Terry Black’s BBQ — visit Egypt and Greece, try and fail at starting a hot sauce business, and pay for a wedding.

If you’re young and trying to sprint out of the gate ASAP, then you’re in luck because time is on your side. The first step is to get your income up.

On August 12, 2023, I invested my first $100,000 — a big financial milestone. Last month, I hit another financial milestone: $200,000 invested. That day, I wrote in my journal, “When I hit $100k, I thought my life would change. It didn’t. Now I’m at $200k and my life still hasn’t changed.”

In retrospect, that wasn’t 100% accurate — my life did change a lot during the time I grew my net worth from $100k to $200k. But it had nothing to do with money, and everything to do with relationships. I married the love of my life. I went to the weddings of some of my best buddies from High School and College. I went on vacation to South Carolina with my family. I don’t have enough money. Because I never will. But I still have more than enough.

The Wealth Ladder is the exact book that I needed at this moment in my life. If you’ve read this far, it’s likely that it’s the exact book you need, too. Like Nick, my goal is to build wealth my own way — the Grant Varner way.

Whew… you made it! 2,500 words later. As always…

Thanks for reading.

— Grant Varner

Guvenen, Fatih; Karahan, Fatih; Ozkan, Serdar; & Song, Jae. What Do Data on Millions of U.S. Workers Reveal about Life-Cycle Earnings Dynamics? Federal Reserve Bank of New York Staff Report No. 710 (Feb. 2015; rev. Sept. 2019).

Grant, I really like your writing style. Keep going man

I also bought that book after reading your post!